Advocacy Win! Federal Government Freezes Excise Tax Increase

Dear ABLE BC Members and Industry Colleagues,

Earlier today, the federal government released Budget 2023 -- A Made in Canada Plan: Strong Middle Class, Affordable Economy, Healthy Future, which includes a significant win for our liquor and hospitality industries!

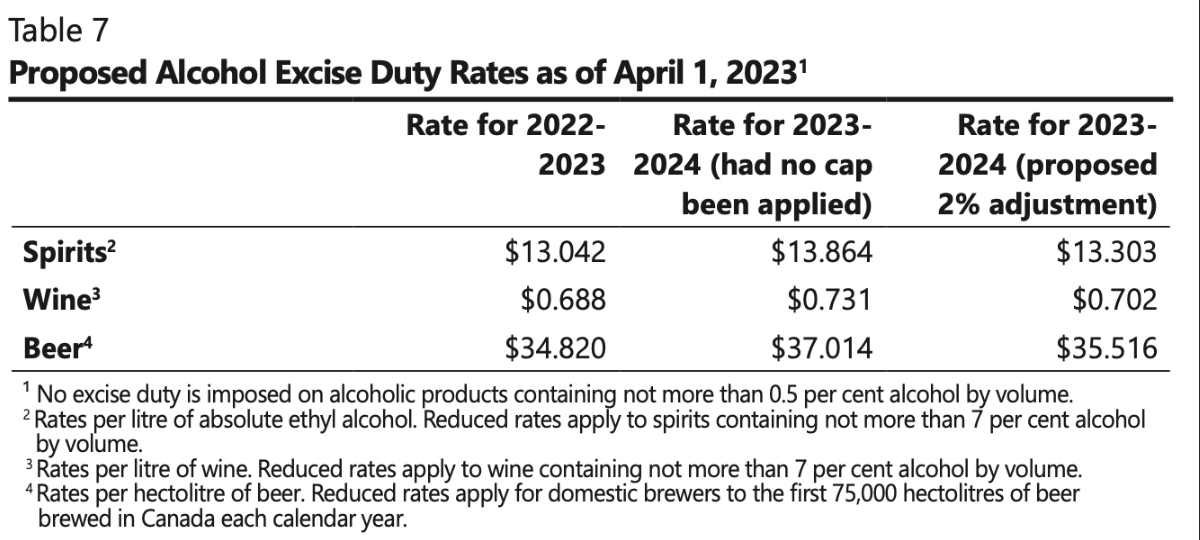

In direct response to months of advocacy from ABLE BC and our industry partners, the planned 6.3 per cent increase to excise duties on alcoholic products is being capped at two per cent for the 2023-22 fiscal year. The new excise duty rates come into effect April 1, 2023.

Excise duties are planned to be tied to inflation, without the two per cent cap, after the 2023-24 fiscal year.

ABLE BC’s Executive Director, Jeff Guignard, says this is welcome news for an industry still struggling to recover financially from the pandemic. “Instead of the largest tax hike in over 40 years, government chose to support our industry’s small businesses exactly when we need it most. We thank our government partners for listening to our needs, doing the right thing, and ensuring we can do our part to keep prices competitive for consumers.”

Unfortunately, wholesale liquor prices are still likely to increase on April 1 as many liquor manufacturers had already submitted new prices to LDB Wholesale in anticipation of the previously announced 6.3 per cent increase. We expect our manufacturing partners will make further adjustments in the coming price periods to reflect this new capped excise duty rate.

The following table shows the previous legislated inflationary increase of 6.3 per cent versus the capped two per cent increase. Click here for more information on sales and excise tax measures.

“I have never been more optimistic about the future of our country than I am today," says the Honourable Chrystia Freeland, Deputy Prime Minister and Minister of Finance. “Budget 2023 will deliver new, targeted inflation relief for the Canadians who need it most; stronger public health care, including dental care for millions of Canadians; and significant investments to build Canada’s clean economy.”

Other highlights from Budget 2023 include:

Supporting growth in tourism with a $108 million investment to support communities and small businesses.

Making life more affordable by lowering credit card fees and introducing a one-time grocery rebate.

Growing a green economy with tax credits for clean electricity investments, clean tech manufacturing, clean hydrogen, and zero emission manufacturing.

Click here to view the full budget.